Matt

Lampert

Associate Director,

Head of Fintech and Loyalty Data Science

Sometimes similar to cooking, in life you buy the ingredients for one recipe and end up using them for another. That’s what Matt found himself facing in college, where he studied to be an accountant — only to realize his journey was taking him elsewhere.

I realized I needed a job that allowed me to sink my teeth into a complex problem in order to really feel engaged, and so I opted to go into finance.

When it comes to deciding what to cook at home, Matt also uses data, resorting to the tried and true staples he knows his family will like. A lot of times, that means going back to the classics — like pasta, pizza, or ribs.

Whenever Matt sits down to begin his work day, he also prepares in a similar way: meticulously and strategically. He considers what projects his team is working on and what challenges they’ve encountered and asked for this support on. However, Matt notes, “Most of my days end up not occurring like I envisioned at 8 a.m.”

“Customer experience is by far the most important thing at Wayfair,” Matt has learned during his time at the company. And while Matt may have preferences for how he approaches processes, he’s quick to recognize that Wayfair’s customers aren’t a single, uniform group. Each one brings unique needs, expectations, and shopping behaviors to the table.

“That’s one of the most important perspectives I’ve gained — realizing there isn’t just one customer,’”

Matt explains.

Within their organizations, decision makers are the audacious ones. Unconcerned with the status quo, they make moves designed to free themselves — and their teams — from the stress of fraud prevention.

With Forter, decision makers get guaranteed results so they can focus their time and energy on strategic opportunities that have a bigger impact on their organizations.

© Forter 2025, All Rights Reserved

Back to top

Background

Career Path

Life at Wayfair

A Customer-First Approach

Being a Decision Maker

This story is part of a Decision Makers series featuring industry leaders within our customer base.

REQUEST DEMO

LEARN MORE

CAREER PATH

A Customer-First Approach

Life at Wayfair

With a domain like fraud, it's very reactionary. So I try to spend the first 30 minutes of every day planning and thinking

to get ready for the rapid-fire day ahead.

That expression, ‘You’re not our only customer,’ is something that really got me to step back and helped me understand our customer base is incredibly diverse, so we have to think about how our decisions impact different shoppers and their experiences.

BEING A DECISION MAKER

How Wayfair’s Associate Director meticulously plans and preps

data-driven customer experiences

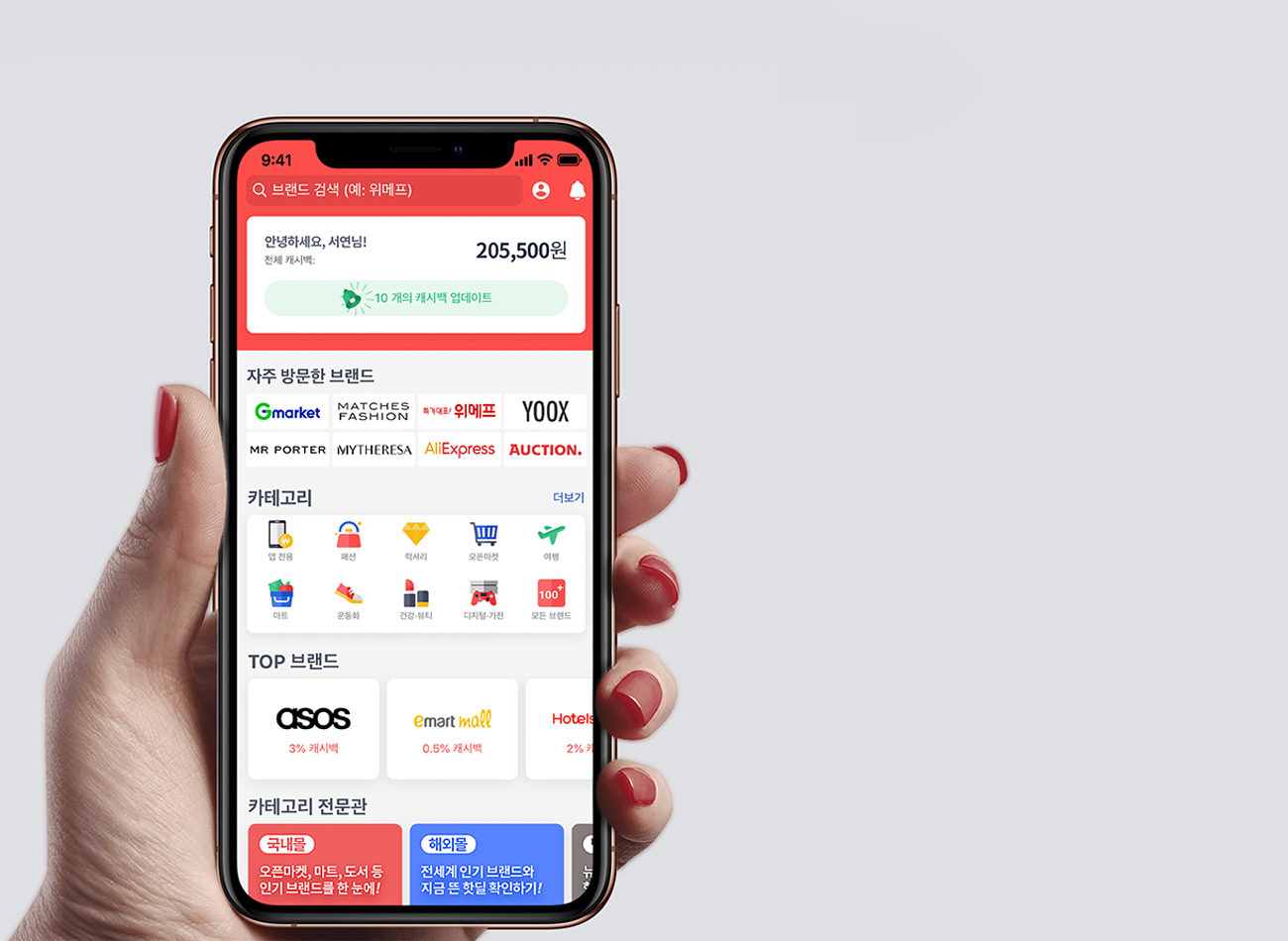

Matt Lampert is used to creating experiences that bring people together. As the Head of Fintech & Loyalty Data Science, Matt leads a broad, data-driven team that handles all of Wayfair's payments, financing, fraud, loyalty, and authentication platforms globally.

A delicate balance of management, decision-making, and data, this role at Wayfair is not the only one Matt uses his meticulous planning skills for — they’ve served him well as a dad, too. At home, he and his wife have become a formidable team, raising two kids together and embracing being in “the thick of the toddler lifestyle” in what Matt calls the “most rewarding job he’s ever had.”

My kids are my favorite chefs to cook with. Being in the thick of the toddler lifestyle is tiring at times, but being a dad is easily the most rewarding job I’ve ever had.

Like a chef, a Decision Maker is only as good as the team they surround themselves with.

This means being strategic in not only delegation but preparation and execution. With his team, Matt acts as a guide from prep to execution, taking into account everyone’s strengths along the way.

Being a Decision Maker is about guiding your team and helping them reach the right goals. It's their journey to learn, but it’s about ensuring that we do the best we can for our customers.

But being a guide can be a two-way street. While Matt may make the decisions for his team at Wayfair, he listens to his sous-chefs, so that together they can serve up better experiences for Wayfair’s customers.

“I definitely lean on my team throughout the entire decision making process. They're involved from day zero all the way through until the final decision.”

At the end of the day, leading is a lot like cooking. So it’s no surprise Matt excels at both.

Getting his start in finance at a small local bank before pivoting into credit risk at Santander, Matt discovered a love for the analytical side of credit risk originations: a complex project he could really sink his teeth into. And over the course of his time at Santander and then T-Mobile, Matt developed and applied those analytical skills, studied and dissected the data, and cooked up bigger and more impactful projects, improving customer experiences and revenue along the way.

However, while Matt enjoyed his work with T-Mobile out west, he and his wife wanted to raise their children surrounded by their families back on the East Coast. Based in Boston and needing someone to whisk up new strategies, Wayfair proved to be the perfect match.

At Wayfair, Matt first led analytics for the Customer Service org before transitioning to Fintech and Loyalty, where he got his first major taste of fraud — an area he resolutely excels in because he likes to “know the data,” “be methodical” and see how “patterns will emerge.”

This time is vital because it prepares Matt to engage with whoever is at his table in an effective manner: his team, senior leaders, and, most importantly, Wayfair’s customers. And together, they’ve found fraud strategies that work for Wayfair.

“We believe that every part of the customer journey should be personalized in order to create a seamless experience that works for everyone — and that includes the fraud protection and prevention aspects,” he adds. “We're tailoring the experience our customers have on site to the fraud detection that we're actually employing.”

To create experiences that align with customers’ needs and tastes while also supporting Wayfair’s growth, Matt doesn’t just rely on his team but partners like Forter. Fraud is not an outsourced problem at Wayfair – but it’s not just an in-house one, either. Instead, Matt continues to bring everyone to the table to problem solve and find solutions that work.

“At Wayfair, false positive rate is a really, really important metric that we focus on — making sure we're not harming good customers by accidentally declining them. We optimize for the maximum possible approval rate, but also have a zero tolerance for chargebacks,” he notes. “That's our goal. We tend to push the bounds on the approach we take — we want to do absolutely everything we can to leave our customers with amazing experiences.”

If I think about the work that we do for fraud, it's very much the same as cooking. We bring together disparate data and create something perfectly balanced.

“Ultimately trying to find a strategy that enables us to reduce the cost of fraud and approve the most possible revenue — which at times, can result in a product that is quite different from what it began as.”

In this parenting journey, one of Matt’s favorite pastimes is a hobby turned responsibility — cooking. “It all comes back to food. My favorite things to cook are the slow ones. Things like pasta where you get to take your time, or caramelizing onions for French onion soup — watching them go from a giant pile in the pot to next to nothing. That's the fun part: getting to see the end result of that prep and watching my kids enjoy it, too.”

Matt

Lampert

Sr. Director of Buyer Risk

REQUEST DEMO

How Wayfair’s Associate Director meticulously plans and preps data-driven customer experiences

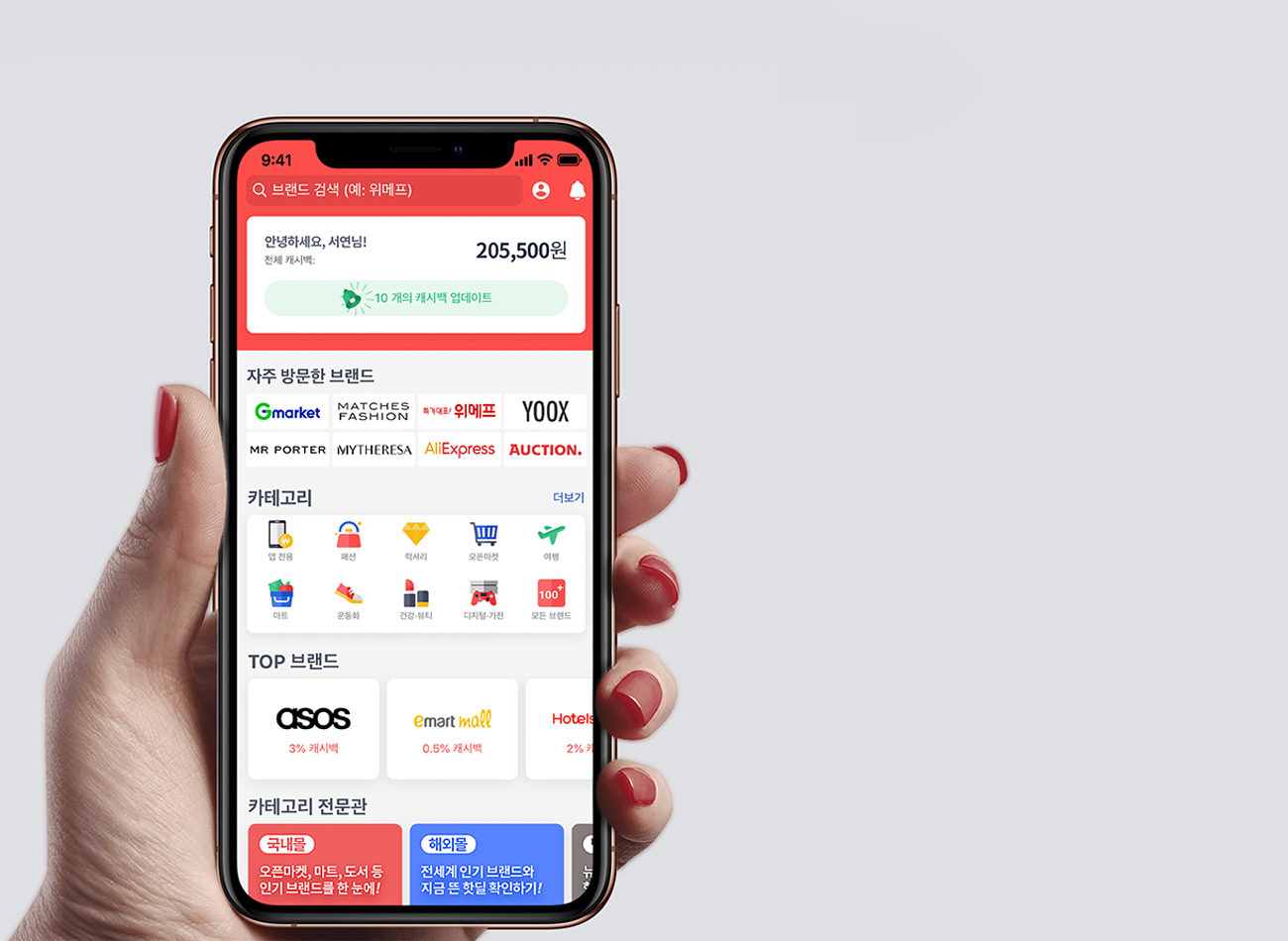

Matt Lampert is used to creating experiences that bring people together. As the Head of Fintech & Loyalty Data Science, Matt leads a broad, data-driven team that handles all of Wayfair's payments, financing, fraud, loyalty, and authentication platforms globally.

A delicate balance of management, decision-making, and data, this role at Wayfair is not the only one Matt uses his meticulous planning skills for — they’ve served him well as a dad, too. At home, he and his wife have become a formidable team, raising two kids together and embracing being in “the thick of the toddler lifestyle” in what Matt calls the “most rewarding job he’s ever had.”

Gardening isn’t just a hobby; it’s truly a way for me to unwind and find balance. It helps me better understand patience and helps me work on my attention to detail.

This story is part of a Decision Makers series featuring industry leaders within our customer base.

Within their organizations, decision makers are the audacious ones. Unconcerned with the status quo, they make moves designed to free themselves — and their teams — from the stress of fraud prevention.

With Forter, decision makers get guaranteed results so they can focus their time and energy on strategic opportunities that have a bigger impact on their organizations.

© Forter 2024, All Rights Reserved

LEARN MORE

Back to top

CAREER PATH

Sometimes similar to cooking, in life you buy the ingredients for one recipe and end up using them for another. That’s what Matt found himself facing in college, where he studied to be an accountant — only to realize his journey was taking him elsewhere.

Early on, I discovered how much I enjoyed fraud prevention. The thrill of uncovering hidden patterns and unraveling complex schemes fueled my passion for making a difference.

When it comes to deciding what to cook at home, Matt also uses data, resorting to the tried and true staples he knows his family will like. A lot of times, that means going back to the classics — like pasta, pizza, or ribs.

Whenever Matt sits down to begin his work day, he also prepares in a similar way: meticulously and strategically. He considers what projects his team is working on and what challenges they’ve encountered and asked for this support on. However, Matt notes, “Most of my days end up not occurring like I envisioned at 8 a.m.”

LIFE AT WAYFAIR

In the garden, you're constantly monitoring and adjusting to the needs of your plants. Leading a team requires similar vigilance and adaptability. You

need to be attentive to the changing landscape, ready to address challenges, and nurture potential wherever you find it.

A CUSTOMER-FIRST APPROACH

“Customer experience is by far the most important thing at Wayfair,” Matt has learned during his time at the company. And while Matt may have preferences for how he approaches processes, he’s quick to recognize that Wayfair’s customers aren’t a single, uniform group. Each one brings unique needs, expectations, and shopping behaviors to the table.

“That’s one of the most important perspectives I’ve gained — realizing there isn’t just one customer,’” Matt explains.

Staying ahead of fraud requires investing in the right technology and being proactive. With Forter, we access a wealth of network data and fraud expertise, reducing friction for legitimate customers while maintaining robust fraud prevention.

BEING A DECISION MAKER

Like a chef, a Decision Maker is only as good as the team they surround themselves with.

This means being strategic in not only delegation but preparation and execution. With his team, Matt acts as a guide from prep to execution, taking into account everyone’s strengths along the way.

But being a guide can be a two-way street. While Matt may make the decisions for his team at Wayfair, he listens to his sous-chefs, so that together they can serve up better experiences for Wayfair’s customers. “I definitely lean on my team throughout the entire decision making process. They're involved from day zero all the way through until the final decision.”

At the end of the day, leading is a lot like cooking. So it’s no surprise Matt excels at both.

Being a Decision Maker means embracing the responsibility of driving progress and leading others with clarity and purpose, even when the path ahead may feel unclear.

In this parenting journey, one of Matt’s favorite pastimes is a hobby turned responsibility — cooking. “It all comes back to food. My favorite things to cook are the slow ones. Things like pasta where you get to take your time, or caramelizing onions for French onion soup — watching them go from a giant pile in the pot to next to nothing. That's the fun part: getting to see the end result of that prep and watching my kids enjoy it, too.”

Getting his start in finance at a small local bank before pivoting into credit risk at Santander, Matt discovered a love for the analytical side of credit risk originations: a complex project he could really sink his teeth into. And over the course of his time at Santander and then T-Mobile, Matt developed and applied those analytical skills, studied and dissected the data, and cooked up bigger and more impactful projects, improving customer experiences and revenue along the way.

However, while Matt enjoyed his work with T-Mobile out west, he and his wife wanted to raise their children surrounded by their families back on the East Coast. Based in Boston and needing someone to whisk up new strategies, Wayfair proved to be the perfect match.

At Wayfair, Matt first led analytics for the Customer Service org before transitioning to Fintech and Loyalty, where he got his first major taste of fraud — an area he resolutely excels in because he likes to “know the data,” “be methodical” and see how “patterns will emerge.”

This time is vital because it prepares Matt to engage with whoever is at his table in an effective manner: his team, senior leaders, and, most importantly, Wayfair’s customers. And together, they’ve found fraud strategies that work for Wayfair.

“We believe that every part of the customer journey should be personalized in order to create a seamless experience that works for everyone — and that includes the fraud protection and prevention aspects,” he adds. “We're tailoring the experience our customers have on site to the fraud detection that we're actually employing.”

To create experiences that align with customers’ needs and tastes while also supporting Wayfair’s growth, Matt doesn’t just rely on his team but partners like Forter. Fraud is not an outsourced problem at Wayfair – but it’s not just an in-house one, either. Instead, Matt continues to bring everyone to the table to problem solve and find solutions that work.

“At Wayfair, false positive rate is a really, really important metric that we focus on — making sure we're not harming good customers by accidentally declining them. We optimize for the maximum possible approval rate, but also have a zero tolerance for chargebacks,” he notes. “That's our goal. We tend to push the bounds on the approach we take — we want to do absolutely everything we can to leave our customers with amazing experiences.”

Being a Decision Maker is about guiding your team and helping them reach the right goals. It’s their journey to learn, but it’s about ensuring that we do the best we can for

our customers.

“Ultimately trying to find a strategy that enables us to reduce the cost of fraud and approve the most possible revenue — which at times, can result in a product that is quite different from what it began as.”

Background

Career Path

Life at Wayfair

A Customer-First Approach

Being a Decision Maker